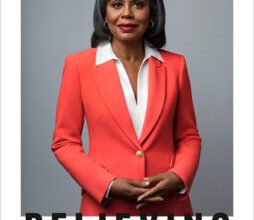

James sues MoneyGram for allegedly violating consumer protection laws

New York Attorney General Letitia James said on Thursday that she has collaborated with the Consumer Financial Protection Bureau (CFPB) in filing a lawsuit against one of the largest international money transfer providers in the United States — MoneyGram International, Inc. and MoneyGram Payment Systems, Inc. (MoneyGram) — for allegedly repeatedly failing to transmit money to Caribbean and other recipients in a timely manner.

Consequently, James charged that MoneyGram repeatedly violated consumer protection laws.

“MoneyGram failed to deliver funds to recipients in a timely manner or refund consumers when transfers were delayed,” she said. “MoneyGram’s unfair practices largely impacted immigrant communities, who relied on the company to send money back home to loved ones.”

The lawsuit alleges that MoneyGram did not accurately notify consumers when their transfers would be available to recipients abroad, and failed to implement required policies and procedures designed to help protect consumers, “essentially leaving consumers in the dark about their money transfers when something went wrong.”

Attorney General James and the CFPB’s lawsuit seeks to protect consumers by stopping MoneyGram from continuing its “unfair and unlawful practices.”

“Our immigrant communities trusted MoneyGram to send their hard-earned money back home to loved ones, but MoneyGram let them down,” James said. “Consumers deserve to know where their money went. Companies have an obligation to be transparent with consumers, treat them fairly and follow the law, but MoneyGram repeatedly failed to do so.

“Today, we are suing MoneyGram to correct their unlawful practices and prevent them from further harming consumers,” she added. “New Yorkers can trust that my office will always protect them from unscrupulous companies.”

CFPB Director Rohit Chopra said “MoneyGram spent years failing its customers and failing to follow the law, ignoring customer complaints and government warnings in the process,” adding that “MoneyGram’s long pattern of misconduct must be halted.”

James said MoneyGram is a non-bank financial services company that enables consumers to send money, known as remittances, from the United States to more than 200 countries and territories, including many in the Caribbean.

The company has 430,000 locations in the US and worldwide, and also operates through a digital platform, James said.

She said a significant portion of the company’s money-transfer transactions are initiated by immigrants or refugees in the US, sending money back to their native countries.

The New York Attorney General said hundreds of thousands of New Yorkers use MoneyGram every year for millions of transactions.

For example, in 2020, she said more than 600,000 individuals sent and received money at MoneyGram locations in New York over 3.8 million times.

“People who send remittances are often low-income or facing other financial constraints and are less likely to have extra money to replace delayed money intended for family or other recipients abroad,” said James, charging that MoneyGram violated US federal and state consumer protection laws.

Specifically, the Office of the New York Attorney General (OAG) and the CFPB allege that “MoneyGram left its customers empty handed when funds were not made available to recipients on time.”

“As a money transfer provider, MoneyGram has to comply with the Bank Secrecy Act and anti-money laundering laws and, therefore, has to conduct screening before transactions are complete,” the lawsuit says. “But even after completing the necessary screenings, MoneyGram held remittance transfers in limbo after they were cleared, which, in some instances, resulted in needless delays of days or even weeks before it completed the transfers or refunded the money to the sender.”

The lawsuit also alleges that MoneyGram “failed to accurately disclose the date of availability of funds” and “repeatedly failed to provide fund availability dates that were accurate.

“Dates disclosed to consumers, repeatedly, were wrong such that there were delays in making funds available to recipients,” the lawsuit says. “MoneyGram failed to promptly investigate errors, to make a determination of whether an error occurred within a required time period, to report the result of an error investigation to the consumer within a required time period, to provide a sufficient written explanation of findings or provide required notice of the sender’s right to request documents related to the investigation, and to provide fee refunds to remedy certain errors.”

In addition, the lawsuit says MoneyGram “failed to put in place policies and procedures designed to ensure compliance with the law, including error-resolution requirements and document retention obligations. And, accordingly, MoneyGram failed to retain certain evidence.”

James said that, in 2009, the company agreed to pay US$18 million to settle fraud charges brought by the US Federal Trade Commission (FTC), and was required to implement a comprehensive anti-fraud and agent-monitoring program.

The New York Attorney General also said that, in 2012, MoneyGram agreed to forfeit US$100 million and entered into a deferred prosecution agreement with the US Department of Justice (DOJ), “admitting it criminally aided and abetted wire fraud and failed to maintain an effective anti-money laundering program.”

In 2016, James said MoneyGram agreed to pay US$13 million to 48 states, including New York, and the District of Columbia, to compensate defrauded consumers and resolve a multi-state investigation into MoneyGram’s anti-fraud practices.

Additionally, in 2018, James said MoneyGram agreed to pay US$125 million, again to the FTC, to settle allegations that it failed to take steps required under the agency’s 2009 order.

According to the FTC, that payment was also part of a global settlement that resolved allegations that MoneyGram violated the 2012 deferred prosecution agreement with the DOJ.

In March of 2022, MoneyGram agreed to pay US$8.25 million for failing to adequately monitor agents engaging in suspicious transactions to China, James said.

She said the lawsuit seeks monetary relief for impacted consumers, an injunction to stop future violations and imposition of civil money penalties.